Now is a favorable risk/reward setup for this Discretionary stock as we head into an important earnings report. Earnings Preview: A 6% Stock Price Move ExpectedĭPZ’s 5-year weekly chart illustrates that the stock has hit key support near just above the $300 mark. That’s about in-line with previous expected moves and the stock has not swayed too much over its recent quarterly reports. The options market has priced in a 6.1% post-earnings stock price move using the nearest-expiring at-the-money straddle. Moreover, Domino’s has missed earnings estimates in the past three quarterly releases. Unfortunately for the DPZ bulls, there have been three net downgrades of the stock since its last profit report. If that amount verifies, it would be a 4% year-over-year earnings drop. Corporate Event Calendarĭata from Option Research & Technology Services (ORATS) show a consensus EPS estimate of $2.99 for DPZ. 13 BMO with a conference call immediately after results hit the tape. Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3 2022 earnings date of Thursday, Oct. DPZ: Earnings, Valuation, Dividend Forecasts

10 shares of dominos stock free#

Finally, Domino’s has a steady free cash flow yield, which should allow for shareholder-accretive activities. DPZ’s PEG ratio is thus reasonable at less than 2, but the firm’s EV/EBITDA multiple is quite elevated. The stock’s high operating P/E ratio makes sense given a resumption of strong EPS growth next year. Dividends are also expected to increase into 2023. On valuation, analysts at BofA see earnings per share falling slightly this year but then rebounding sharply in 20. dollar and high competition in the fast-food pizza industry. Downside risks include a continued strong U.S. Moreover, a strong worldwide presence helps to diversify operations. Ahead of earnings this week, just 4.2% of shares are short.ĭomino’s has significant upside potential with falling year-on-year wage growth gains for low-end jobs along with improving supply chains across the globe.

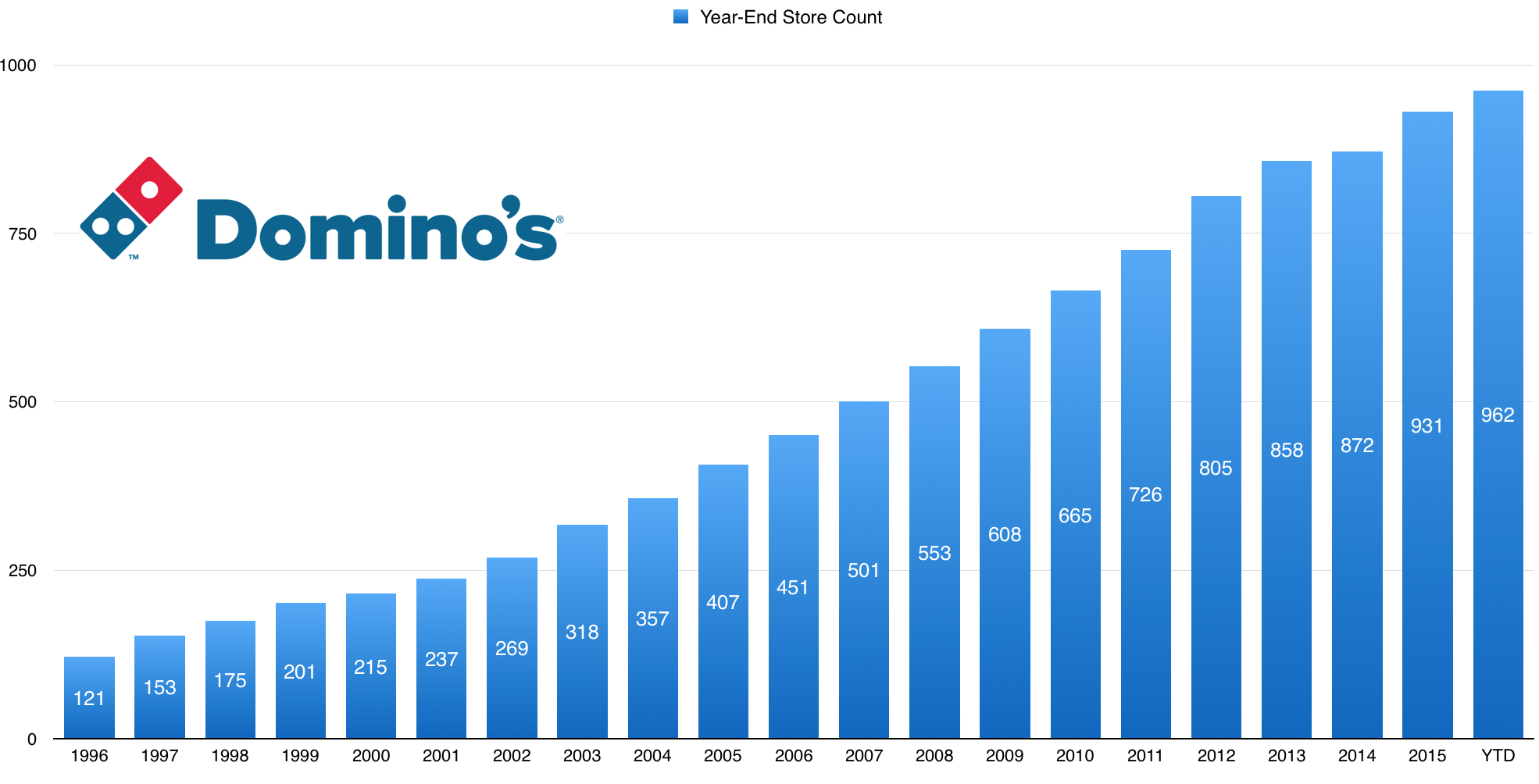

The Michigan-based $11.3 billion market cap Hotels, Restaurants & Leisure industry company within the Consumer Discretionary sector trades at a high 24.6 trailing 12-month GAAP price-to-earnings ratio and pays a small 1.4% dividend yield, according to The Wall Street Journal. The company has been benefitting from a steadily growing online/digital ordering mix that currently represents over 60% of domestic orders and has a long runway for growth. DPZ's system is more than 97% franchised and 63% of stores are located internationally. 1 pizza delivery company in the world with roughly 16,000 stores in 50 states and more than 70 countries. Industry Fundamental Trends: Falling Labor Wage Growth, Easing Commodity Prices Expected, Extremely Favorable FAH-FAHM SpreadĪccording to Bank of America Global Research, Domino's Pizza ( NYSE: DPZ) is the No.

One popular pizza company kicks off earnings season this week. Finally, the all-important food at home minus food away from home (FAH-FAFH) remains hugely in favor of restaurants. Is the tide turning on rising labor costs and soaring commodity prices? It might just be so.Īccording to Bank of America, the year-on-year change in wage growth for food service workers peaked at +15% earlier this year and has since fallen to just +8% as of June.Īs for wholesale food prices, those are expected to be in outright decline, according to Bloomberg data.

0 kommentar(er)

0 kommentar(er)